Executive Summary

The nonprofit sector has long suffered under funders’ insufficient reimbursement of indirect costs. The OMB Federal Guidance in 2014 improved this situation by requiring that federal grants and contracts—whether direct or passed through states or other entities—offer three options for indirect cost reimbursement: 1) nonprofits keep a federally negotiated indirect cost rate (NICRA); 2) nonprofits negotiate a rate directly with the state or local government; or 3) those without a NICRA or desire to negotiate get 10% de minimis.

In the case of pass-through funding, OMB Federal Guidance is often not followed. Nonprofits need the law to be followed in pass-through funding, just like in direct federal funding. Nonprofits also need improvements in the reimbursement of indirect costs in state and local grants and contracts.

Insufficient reimbursement of indirect costs undermines nonprofits’ financial stability and restricts their effectiveness. The fair solution is to provide full-cost funding (i.e., reimbursement of the full costs of services). Coalitions of nonprofits in Illinois, Maryland, New York City, and Washington, DC, have successfully advocated for state and local government agencies to follow the OMB guidance in pass-through federal funding and apply the same guidance to their direct grants and contracts.

Based on the experiences of Jeremy Kohomban in New York City and Lori Kaplan in Washington, DC, and with the input of other Leap Ambassadors, this document offers tips for leaders on making the case for advocacy to board and staff, convincing fellow CEOs to join the advocacy effort, recruiting philanthropic allies, and explaining the problem—and what to do about it—to government officials. Appendices include links to calculating full costs, advocacy resources, and passed legislation, as well as examples of testimonies, and a fact sheet from Washington, DC.

Introduction

Years ago, Lori Kaplan, then-CEO of the Latin American Youth Center, calculated that she had to raise $500,000 annually to cover indirect costs incurred—but not covered—by government contracts. The organization had about 25 government contracts, all allowing different—and insufficient—indirect-cost rates. With government funds making up approximately 65% of the organization’s ~$18 million budget, the amount of money Kaplan had to raise to cover the deficit was threatening the organization’s financial stability to the point that the board wanted to stop taking government grants that didn’t cover the full costs of services.

The idea that all funding should go directly to programs—and that paying for “overhead” is wasteful—is deeply ingrained in public attitudes. While the nonprofit world has tried for years to change the paradigm, most funders still refuse to pay the full cost of services delivered by the nonprofit sector. In recent years—including during the COVID-19 pandemic—there have been positive signs in the foundation world. Foundation grants, however, account for only 2.9% of nonprofit funding. For the sake of survival and sustainability, nonprofits need changes in government grants and contracts, which account for 31.8% of their funding.

One positive development in government came in 2014, when the federal government issued uniform—and fairer—guidance for indirect-cost reimbursement. However, many states and localities have refused to follow the federal guidance and continue to starve the nonprofit sector of required, and often legally mandated, indirect rates. Below, ambassadors provide suggestions, based on experiences in New York City and Washington, DC, for advocacy efforts that could lead to full reimbursement of indirect costs from state and local governments. We believe successful advocacy for indirect reimbursement could be key to survival for many nonprofits in these hard times.

A Jumping-Off Point: OMB Uniform Guidance

In recent years, Illinois, Maryland, New York City, and Washington, DC, have taken steps to follow Office of Management and Budget (OMB) Guidance on indirect-cost reimbursement. Each modeled their advocacy efforts on the Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards, known as OMB Uniform Guidance, introduced in 2014 and updated in 2020.

The guidance allows for a fairer allocation of required expenses toward direct costs (e.g. support staff dedicated to a specific program) and offers three options for indirect-cost reimbursement: 1) nonprofits keep a federally negotiated indirect cost rate (NICRA); 2) nonprofits negotiate a rate directly with the state or local government; or 3) those without a NICRA or desire to negotiate get 10% de minimis. While 10% is rarely sufficient, the de minimis option helps small nonprofits, in particular, who previously received 0% indirect cost reimbursements and don’t have the resources to go through negotiation.

The OMB Uniform Guidance applies to all federal funds, whether direct or passed through states or other entities. Many states, cities, and counties, however, refuse to pass along the legally mandated percentage of indirect costs to nonprofit partners.

As for funding from state and local government, indirect cost reimbursement rates vary widely. One study found that 2016 human services contracts in New York City allowed indirect rates between 0 and 17%—with an average of 8.6%.

The OMB Uniform Guidance created a jumping-off point for nonprofits to advocate for two things at the state and local levels: 1) adherence to the reimbursement rates required for pass-through federal funding; and 2) similar guidelines for state and local governments’ contracts with nonprofits.

State and Local Successes and Set-Backs

Insufficient reimbursement rates is a question of more than fairness. “Especially now, when funding is hard to raise, reasonable reimbursement with government contracts would help nonprofits survive and sustain services,” wrote Dave Coplan, executive director of the Human Services Center in the Pittsburgh area.

By the time the COVID-19 pandemic hit, Illinois, Maryland, and New York City had introduced changes to nonprofit contracts that aligned with the OMB Uniform Guidance (Illinois in 2014, Maryland in 2018, New York City in 2019). In New York City, the funding was only allocated for fiscal year 2020’s budget after a long fight led by the Human Services Council (HSC). Then, “due to the pandemic,” funding was reduced to 60% of what had been promised. Children’s Village CEO Jeremy Kohomban has been involved in these multi-year advocacy efforts in his role as chair of the New York Human Services Council. He said, “To take away indirect costs fundamentally changes the trajectory of many nonprofits who have thin margins and are counting on indirect costs being funded. Our sector will keep fighting.”

In Washington, DC, legislation was with the City Council when the pandemic hit. In July 2020, the council dedicated $200,000 to conduct a cost-implication study, and in December 2020, the legislation was passed. Kaplan, a leader of the DC advocacy effort, said, “As FY ‘21 begins, we’ll proceed with advocacy efforts to implement the legislation. The cost implication study will inform our work.”

The Problem: Restricting Nonprofit Effectiveness

Aside from the obvious unfairness of government contracts not fully covering what it costs nonprofits to deliver the services (What for-profit is expected to take a contract that doesn’t pay its costs?), this system has implications that constrain organizations’ potential to meet their missions.

Time and effort. Filling the gap is extremely time-consuming. Some CEOs spend up to 40% of their time “dealing with indirect-cost reimbursement issues, between negotiations and fundraising to cover the gaps.” Many foundations still put caps on indirect-cost spending, and the availability of general operating support is limited, making it difficult to find foundation funding to fill the gap.

Finances. Nonprofits typically conform with funders’ unrealistic expectations for what it takes to run an organization by spending too little or underreporting true costs. Thanks to the nonprofit starvation cycle, coined by Ann Goggins Gregory and Don Howard in 2009, many nonprofits were already in a precarious financial position prior to COVID-19. When Bridgespan looked at 274 of the most highly co-funded nonprofits of the top 15 U.S. foundations, they found that half (53%) suffered from frequent or chronic budget deficits, and 40% had fewer than three months of reserves. Government contracts that don’t pay full costs only contribute to what consultant David Hunter refers to as the “hollowing out” of nonprofits.

Effectiveness. The Nonprofit Overhead Cost Project found that often organizations receiving the most restricted funding (with inadequate reimbursement of indirect costs) were hampered by poor infrastructure, including computers and facilities; poorly paid, inexperienced, and poorly trained staff; unfilled positions; and more. Those receiving more unrestricted funding did better. As the Nonprofit Finance Fund’s Claire Knowlton points out, an outcome-based approach requires investment in an organization’s capacity to deliver high-quality services, systems to track progress over time, and flexibility to pivot as needed.

The Solution: Full-Cost Funding

All contracts and grants should cover the full costs of delivering high-quality services that lead to desired results. Knowlton argues that “Full costs include day-to-day operating expenses (both program and overhead expenses) plus a range of balance sheet costs for short-term and long-term needs.” She proposes this formula for full costs:

Day-to-day operating expenses + working capital + reserves + fixed asset additions + debt principal repayment = full costs

Unfortunately, too many nonprofit leaders don’t understand their full costs, so their funders don’t either. Others avoid raising the issue for fear of retaliation. According to Kaplan and Kohomban (who were both met with disbelief when they brought it up), your local government officials likely don’t even know there’s a problem. Since government is always fully funded with very high indirect costs, they may assume that nonprofits are treated the same.

In the following sections, we share tips for how to make the case to your board and staff, your fellow nonprofit leaders, potential philanthropic allies, and government officials. Appendix A provides general resources for advocacy, as well as the legislative language used in Illinois, Maryland, New York, and Washington, DC.

Making the Case for Advocacy to Your Board and Staff

If you want to advocate for full-cost funding with your state or local government, figure out what your full costs are (refer to appendix A for resources) and get internal support. Kaplan and Kohomban found these talking points effective for board and staff:

- The law: Federal pass-through funding must comply with the OMB Uniform Guidance. If our state or local government isn’t giving us what we’re entitled to, the law is on our side.

- Fairness: It’s only fair that state and local government also pays for the full costs of the services they contract with us to provide. No private-sector company would be expected to subsidize government services as nonprofits are forced to.

- Finances:If the government paid the full cost of services, it would save time and effort, prevent erosion of our financial condition (especially in hard economic times, when it’s challenging to raise unrestricted funds from foundations and individuals), and allow us to focus on other important things, such as fair pay for workers, investments in technology and outcome measurement, and continuous improvement in program quality leading to better outcomes for our clients.

- Important to small organizations: This issue is especially important for smaller nonprofits without a negotiated federal rate. Pass-through federal funding would increase from 0 to 10%. If the state/local government aligns its direct funding with the OMB Uniform Guidance, the same would be the case in those grants and contracts.

- Stewardship: We’re obligated to do what’s best for our clients, communities, staff, and organization. Our organization’s survival and its ability to provide effective services are vital to the people and communities we serve.

- Great starting point: Others have successfully advocated for state/local legislation based on the OMB Uniform Guidelines. We can do it, too.

Convincing Your Fellow CEOs to Join the Advocacy Effort

No one or two organizations are likely to succeed independently, as Dominique Bernardo, CEO of Variety the Children’s Charity of the Delaware Valley, experienced in Philadelphia. In the words of Philadelphia Deputy Mayor Cynthia Figueroa, Office of Children and Families, “Government guidelines are often capped for really no solid reason. The greatest challenge is getting enough like-minded nonprofits together to submit a meaningful position.” In New York City, 176 organizational members of the Human Services Council participated. In Washington, DC, Kaplan brought together about 40 nonprofit leaders—including CFOs and experts in policy and advocacy—to create the Coalition for Nonprofit Equity. One member of the coalition assigned her legislative and policy director, a lawyer, to work with Kaplan: “This was incredibly helpful as we studied other legislation, OMB documents and continuously tweaked the legislation as needed.”

Here are some reasons to join, in addition to the ones listed above:

- Strength in numbers: None of us can achieve this on our own, but together we can make it happen. Others have done it.

- Minimizes risk of retribution: If we join forces, no single organization will stand out and the risk of being punished for challenging government practice is reduced.

Kohomban recommends being prepared for internal opposition, which took the New York coalition by surprise. He said, “If you’re lucky, you will know who is fighting against you. In most instances, you will not see or hear the opposition directly.” They learned that a few fellow nonprofit leaders opposed the effort out of fear. Some were silent. They refused to be identified among those calling for action and, in doing so, hoped to benefit no matter what happened. If the coalition was successful, they would gain from the new indirect rates. If New York City and its powerful allies retaliated, they would claim that they were an ally of the city and therefore deserving of favors. There were also those who worked actively against them by being a conduit for New York City’s position that the city could do no more, concurrently stoking fears of retaliation in the form of denied or delayed contracts. While that was unlikely, the actions were nevertheless intimidating and effectively sowed seeds of disunity.

Recruiting Philanthropic Allies

Strong philanthropic allies were important in New York City, but they weren’t easy to recruit. “Among private leaders, not everyone who complains is willing to take the public risk, collaborate, and fight the battle,” Kohomban said. Doug Bauer, Executive Director of the Clark Foundation, was an early exception: “To me, covering indirect costs is just plain common sense and an equity issue. I continue to be amazed that so many in the sector still cling to the overhead myth – especially in the midst of a pandemic.” Find a sample letter of philanthropic support from Nicky Goren of the Meyer Foundation, a DC funder, in appendix D. These arguments persuaded the allies:

- Stop subsidizing government: When government doesn’t pay what it costs, philanthropy has to fill the gap. Let’s put an end to foundations having to subsidize government services. (Note: Be careful when making this argument, to avoid implying that foundations should stop covering the gap to provoke government change. Their funding to cover the gap is critical until government funds the full costs of services.)

- Fund advocacy:Advocacy with government takes time and effort. Organizing, strategizing, meeting, and advocating requires funding.

- Lend your voice:Foundation leaders’ public support carries weight. We need you.

Explaining the Problem—and What to Do About It—to Government Officials

Kaplan and Kohomban found that most government officials were unaware and needed a good deal of help to understand the problem. In Washington, DC, advocates frequently used a fact sheet (appendix E). Whether in a fact sheet or in other communications, here are some points worth emphasizing:

- The law: State/local governments must follow OMB Uniform Guidance about federal pass-through funding; it’s the law.

- Fairness: Nonprofits should be paid the full costs of the services they provide, just like any private contractor. We need direct funding from state and local governments to follow similar guidance to that at the federal level.

- Mutual need: When we’re not paid the full costs of services, it’s hard to find general operating support to fill the gap, and it threatens organizations’ survival. This threat is particularly grave during hard times, as Elizabeth Boris and her Urban Institute colleagues found after the 2008 recession. It’s in government’s interest that the nonprofits with whom they contract are financially stable and able to provide uninterrupted, effective services to the people who need them. By paying the full cost of those services, governments remove a threat to their partners’ ability to meet the government’s need. Given the problems it causes, funding from other sources shouldn’t be required to fill a gap in reimbursement, but can instead, to the extent available, support additional services.

- Effectiveness: A uniform system for all nonprofit grants and contracts is more efficient than each agency having its own rules. Such uniformity would produce major savings for both nonprofits and governments.

Kaplan worked with her Washington, DC, ward city council representative to author the legislation, using the Maryland legislation as an example. “Then we all got additional city council members to sign on,” Kaplan said. “In the first year the legislation had four council signatures, and when introduced again the following year, we had nine co-signers.” Similarly, in New York City, one supportive council member was gradually joined by more than a dozen supporters.

Hearings are an important opportunity for influence. The CEOs, CFOs, and board members of nonprofits, as well as auditors and representatives from philanthropy are all great people to testify (see appendices B and C for testimonials). In Washington, DC, the opening panel included representatives from Maryland, Illinois, and the National Council of Nonprofits, who framed the issue as a national trend and growing movement for best practices. Substantiating facts and figures can be compelling, and Lindsey Buss at the World Bank pointed out that the Washington, DC, City Council seemed to find persuasive data the advocates had collected from nonprofits, showing how much indirect costs varied from contract to contract and agency to agency.

On the Right Path, But Not There Yet

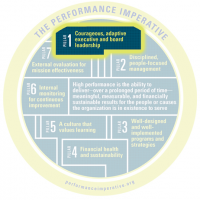

While passing legislation is an important step forward, it doesn’t mean the goal has been reached. The “full” cost, negotiated in New York City and Washington, DC, was to cover the costs nonprofits are currently incurring―a step on the way to what would be fair and equitable: funding the infrastructure required for an organization to become high performing as defined by the Leap Ambassadors Community’s Performance Imperative.

Existing legislation, however, must be funded and implemented. In New York City, complying with a new cost manual was an intensive exercise for nonprofits during fiscal year 2020, involving reclassifying and documenting costs and getting auditor certifications. After the organizations had met these new demands and the fiscal year had ended, they were told they would receive only 60% of the indirect costs for which they had been approved. In some cases, that could be less than what they received prior to the indirect rate agreement, because some costs were reclassified from direct to indirect.

At the time of writing, New York City is seven months into the 2021 fiscal year. Nonprofits have been on the COVID frontlines since March, 2020, but payments for fiscal year 2020 have not been made. The city has asked them to do more but not yet decided how much of the indirect rate it will pay for fiscal year 2021. This puts some nonprofits in a no-better—possibly, in even worse—position than before. Many feel their trust has been betrayed.

Final Words

Kaplan and Kohomban believe advocacy for full-cost funding from government needs to happen across the country. Their takeaway? Be courageous and know it takes time.

“It takes leaders and nonprofit boards willing to take a personal risk by expending their political capital and take the political risk of being ostracized or having their organizations ‘punished’ by public funders and those private nonprofit leaders who are beholden to elected leaders,” Kohomban said. Both New York City and Washington, DC, have experienced setbacks, each adding time to the process. When Washington, DC, experienced a setback after two years of advocacy, Kaplan was encouraged that New York City had passed legislation after four years. In the end, the DC legislation was passed in December, 2020, after three years of advocacy.

The work continues in both New York City and Washington, DC. Kaplan’s and Kohomban’s best advice? Don’t give up.